current location:Home>>Activity details

Time & Venue:

May 17th InterContinental Beijing Financial Street

Xian I Room, 5th Floor, No.11 Financial Street, Xicheng District, Beijing

May 19th Shanghai Park Hyatt

Salon III, 86th floor, Park Hyatt, SWFC, 100 Century Avenue, Pudong New Area, Shanghai

As the two seminars have the same content, please choose one of the above-mentioned seminars to attend.

Language:Translation between Chinese and English

Participation Fees:CVCA member: RMB 2,000 per person,Non member RMB 2500 per person (Open to LP, GP only)

● How is Human Capital - your most important asset, valued and rewarded in your firm?

● Are your professional talents motivated by the appropriate incentives?

● Does your existing incentive / carried interest plan align with your business model & growth stage?

To help you address people challenges in the PE industry, CVCA specially invite McLagan, which is a professional firm concentrating on Compensation Consulting, to hold the 2011 China Private Equity Forum in Beijing, Shanghai respectively.

The aim of this forum is to share and discuss business and reward issues and solutions from the Global, Asia and China perspectives. The forum will help your firm better understand business trends and pay approaches under different business models and development status, and provide a unique opportunity for Private Equity Executives to network and discuss human capital issues.

Agenda:

Guest speaker: Mclagan Team of Professional Compensation & Human Capital Advisors to Global and Regional Financial Institutions: Glen Vilim Stuart Main Robert Li | |

| 12:00 – 12:30 | Reception / Cocktail |

| 12:30 – 13:30 | Introduction / Round Table Lunch |

| 13:30 – 14:00 | Global and Local Private Equity: Business Trends and Organization Models Types of Asset Classes defining "Private Equity" Organization Models Capital Raising Trends & Exit Trends |

| 14:00 –14:20 | Tea Break |

| 14:20 – 15:30 | Global and Local Private Equity: Pay Approach and Incentives Constructs of Annual Pay Carried Interest and How it Works Key Elements of Carried Interest Plan and Market Norm (financial mechanics, splits, allocation, vesting, hold/claw back, etc.) Taxation Considerations How to Bridge Local Operation with Global Practice in China Context? |

| 15:30 – 17:30 | Case Study Led by Forum Speakers: typical case of PE firms Interactive Discussion and Open Q & A: The unique long-term incentive vehicles for PE: design and application of carried interest and co-investment plan under different business models and status |

Registration starts at 12:00am.

Seats are limited. Please make an early reservation. Registration on site is not available.

Enquiry contact

Ms. Phoebe Dai

Tel: 8610-85183584#800

Email: phoebe@cvca.org.cn

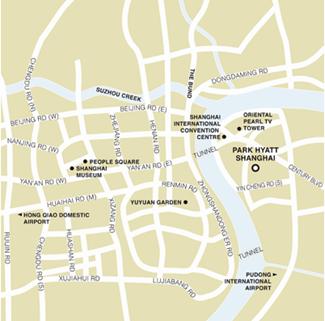

Map:

InterContinental Beijing Financial Street:

Tel: 10-5852 5888

Shanghai Park Hyatt:

Tel: 021-5101 5566

About China Venture Capital and Private Equity Association (CVCA)

The China Venture Capital and Private Equity Association ("CVCA"), incorporated in the middle of year 2002 in Hong Kong, is a member-based trade organization established to promote the interest and the development of venture capital ("VC") and private equity ("PE") industry in the Greater China Region. Currently CVCA has more than 150 member firms, which collectively manage over US$500 billion in VC/PE funds. CVCA members have long and rich experience in VC/PE investing worldwide and have made many successful investments in fast-growing China enterprises of various industries.

To better demonstrate CVCA's member composition and to represent the private equity members in the Greater China region, in November, 2010, China Venture Capital Association officially announced to rename itself as China Venture Capital and Private Equity Association, although its abbreviation and logo will remain unchanged as CVCA.

More information about CVCA, please visit www.cvca.org.cn

About Mclagan

For more than 40 years, McLagan has specialized in providing performance and compensation consulting and various related studies to the financial services sector. We have considerable experience in the complex and competitive world of the industry and has provided consultancy services to Chinese financial institutions since 1998.

Consultants in McLagan are all experienced professionals with financial services background and industry experience, with in-depth knowledge of business trends, pay approaches, short and long-term incentives used in specialized financial sectors.

Established in 1966, McLagan Partners, a wholly owned subsidiary of Aon Hewitt, is headquartered in Stamford, CT with offices in New York, Chicago, London, Tokyo, Hong Kong, Dubai, Shanghai and Minneapolis.