Introduction

CVCA Annual General Meeting & China Venture Capital/Private Equity Summit 2012 (AGM & Summit) will be held on Dec 6 and 7 at Grant Hyatt, Beijing, PRC.

The AGM and Summit is a must-attend event where you will meet, listen to and talk with CVCA governors, the top-notch PE/VC leaders active in the greater China region. It is when CVCA members gather together to share experience and exchange opinions on future trend. The by invitation-only closed-door event provides you an access to a group of sophisticated PE/VC professionals, economists, experts and policy makers. You can rest assure that it's worth it as long as you are there.

In 2012, what are priorities for PE to do with their China strategic planning in the shadow of global economic slowdown? What are the fundraising patterns as well as the alternative exit channel options nowadays? What's the outlook of China's PE/VC industry for the coming year? The AGM and Summit is an ideal forum to discuss such questions and to find answers. It provides a great opportunity for networking and relationship-building with best venture capitalists, private equity investors, limited partners and entrepreneurs.

Join us and don't miss the chance to get you and your organization exposed at CVCA AGM and Summit 2012.

Organizing Committee

China Venture Capital and Private Equity Association (CVCA)

CVCA Annual General Meeting & China Private Equity/Venture Capital Summit 2012

December 7th, 2012 (Friday)

Ballroom, Grand Hyatt, Beijing, China

(Working language: Mandarin. SI available)

| December 6th (Thursday)By invitation only |

| 16:00 - 17:20 | CVCA Board Meeting |

| 17:30 - 20:00 |

LP/GP Roundtable and Dinner(30 max.) Participants: CVCA governors, international and domestic LPs, CVCA guest members Chair: John ZHAO Founder and CEO, Hony Capital |

| December 7th (Friday)Ballroom, LG |

| 8:30 - 9:00 | Registration / Fresh-Up Tea Time |

| 9:00 - 9:10 | Opening Remarks Yichen ZHANG CVCA Chairman / CEO of CITIC Capital |

| 9:10 - 9:30 | CVCA Members Annual General Meeting / IPC update |

| 9:30 - 10:30 |

Dialogue I – What PE to do with their China strategic planning in downturn What are priorities for PE in the shadow of global economic slowdown - raising the bar of management selection, refining the operation, or cutting cost?

Moderator: Yichen ZHANG CVCA Chairman / CEO of CITIC Capital Panelists: Antony LEUNGSenior Managing Director, The Blackstone Group Chairman, Blackstone Greater China Hugo SHONGFounding partner, IDG Capital Partners Andrew Y. YANManaging Partner, SAIF Partners |

| 10:30 - 11:30 |

Dialogue II – Exit Channel Selection While the expectations of going public in the US market for Chinese companies become less optimistic, the domestic capital market is not encouraging. What's the way out of the dilemma for Chinese companies? What are alternative exit channel options for the investors nowadays?

Moderator: Frank TANG CEO and Managing Partner, FountainVest Partners Panelists: Stephanie HuiPartner and Managing Director, Principal Investment Area, Goldman Sachs Duane KUANGFounding Managing Partner, Qiming Venture Partners Weiguo MAPartner and Managing Director, Cowin Venture Capital |

| 11:30 - 12:30 |

Dialogue III – China's PE/VC industry policy How do policies and regulations challenge China's PE/VC industry's further development? The encouraging measures for the emerging industries provided in the Twelfth-Five Year Plan regarding emerging industries of national strategic development planning released by the State Council in 2012. The influence of the Law of Securities Investment Fund Amendment to the VC/PE funds' filing and industry regulation. The key points and progress of new policies on insurance company's investment into equity and real estate sectors. Updates and key points on the law of taxation on partners and partnership businesses. Moderator: Sing WANG Partner, Co-Chairman, TPG Greater China, Head of TPG Growth North Asia Panelists: Lorna CHENPartner, Global Asset Management Group, Shearman & Sterling Jennifer QINLead partner of Investment Management, Deloitte Asia Pacific Roman SHAWManaging Partner, DT Capital Partners |

| 12:30 - 13:30 | Lunch |

| 13:30 - 13:35 | CVCA Chairman Handover Ceremony |

| 13:35 - 13:50 | Keynote speech John ZHAO Founder and CEO, Hony Capital / CVCA Chairman |

| 13:50 - 14:50 |

Dialogue IV: The fundraising patterns and prospect in China's VC/PE market What's the outlook of China's PE/VC industry for the coming year from the perspectives of international LPs and domestic LPs respectively? How to balance the interests between domestic LPs and international LPs? What's the status of insurance companies' investments into RMB funds? What's the difference on investor relations management between RMB funds and USD funds? Moderator: Leenong LI MD, Commonfund Capital Panelists: Christopher HunterMD, Cambridge Associates Investment Consultancy Piau-Voon WANGPartner, AdamsStreet Partners Disheng YINGGM, Division Four, PDSTI |

| 14:50 - 15:30 |

Dialogue V: Value added services and portfolio management How to be a valuable investor? What are the basic principles of investment management and services? How can investors maintain the consistency in interests with companies and entrepreneurs? How to cope with conflict of interest? Corporate governance and management incentives Moderator: Baoma WEN Partner, Capital Today Group Panelists: Nengguang WANGFounding Partner, CFO, Legend Capital Shirley XIEPartner, PwC Lei YANGManaging Director, Northern Light |

| 15:30 - 16:10 |

Dialogue VI: Role of professional service providers in portfolio risk management Professional service providers' value in the legal practice, financial management, and due diligence procedures by risk detection and prevention. Professional service providers' value in investment management and pre-IPO period. Separate account and FoF's future in China GP reporting management outsourcing services Moderator: Weichou SU Partner, StepStone Panelists: Chen BAOPartner, FangDa Partners Henry (Jian) HUANGExecutive Director, Finance Department, Goldstone Investment Ltd. Jeffrey SUNPartner, Orrick, Herrington & Sutcliffe |

Registration

The AGM and Summit is a by invitation-only event.

We sincerely invite you, an important representative in our members firms to attend this event as our guest of honor. To confirm your participation, you can register with us through the following two channels:

1) Fill out the Registration Form,fax it back to: 86 10 8515 0835 or email it back to Registration Contact:

Ms. Lin-lin SONG

Tel :8610-8518 3584 ext. 809

E-mail:lin@cvca.org.cn

Mr. Allen Chen

Tel :86 10 - 8518 3584 ext.807

E-mail:allen@cvca.org.cn

2) The registration hotline at Tel: 86 10 8518 3584 ext. 807

We look forward to seeing you at the AGM and Summit. Thank you very much in advance for your kind support and participation.

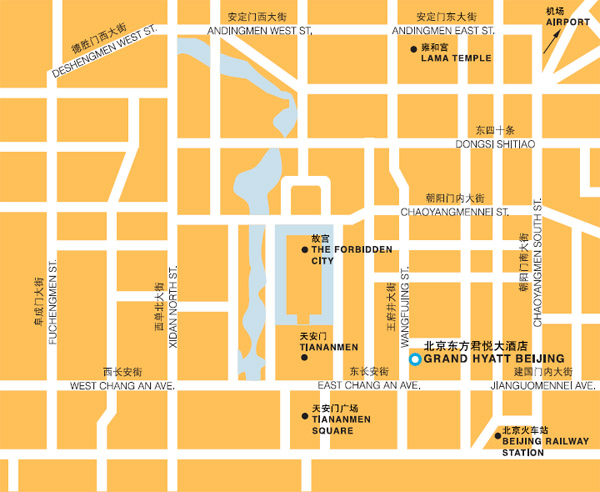

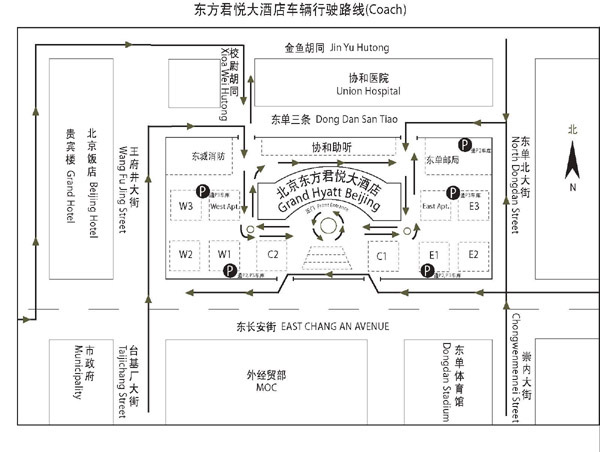

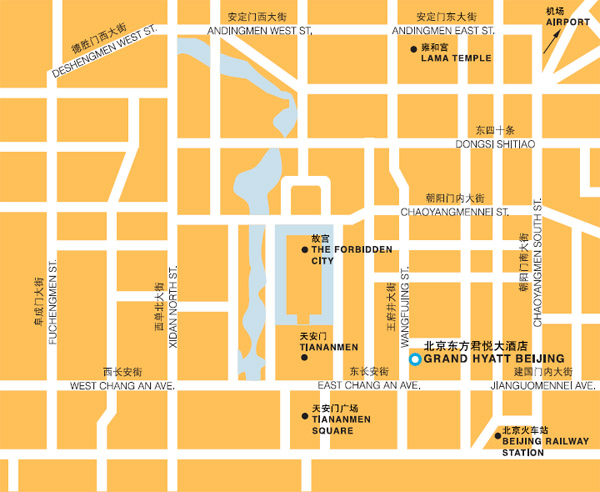

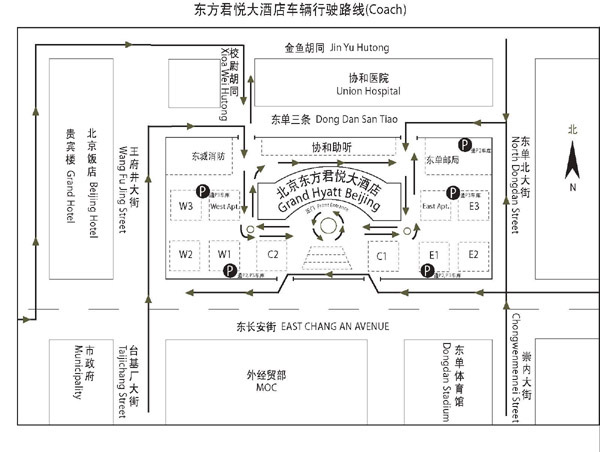

Venue

Grand Hyatt Beijing

1 East Chang An Avenue,

Beijing, People's Republic of China 100738

Tel: +86 10 8518 1234 Fax: +86 10 8518 0000

Email: beijing.grand@hyatt.com